Contents

Marketplaces are an excellent way for professional sellers to rapidly increase their sales. If you're thinking of selling on Darty, you need to think carefully about the various operating costs inherent to the marketplace and your business in general. In this practical guide, find out about Darty's selling costs and our tips for managing your business.

Darty selling expenses: two types of costs

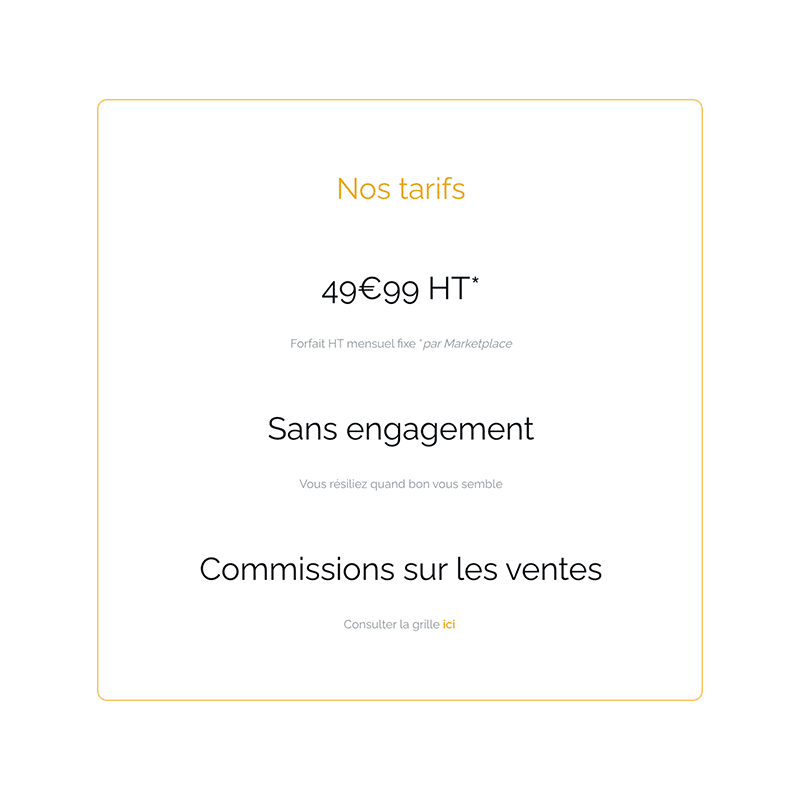

As with the majority of marketplaces such as Cdiscount Marketplace or Fnac Marketplace, you need to pay a certain amount to use the Darty platform. Darty's sales fees break down into two parts: a monthly subscription fee and a commission on sales.

Monthly subscription paid by pro sellers

Each professional seller on the Darty site pays a monthly subscription fee. This gives access to all the functionalities of marketplace : creation of a seller showcase, order management API, messaging API, pricing API, advertising management...

Darty commission on sales

In addition to the fixed monthly subscription fee, the marketplace takes a commission on every sale made on its platform. This commission is used to finance the Fnac-Darty group and to regularly improve the digital tools available to e-merchants.

Selling on Darty: costs marketplace

When you register to become an Amazon seller, the platform lets you choose between two types of profile: Individual Seller and Professional Seller. This choice has an impact on operating costs, and therefore implies different Amazon selling fees.

Monthly subscription at €49.99 excl. tax/month

The cost of the monthly subscription to be a pro seller on Darty Marketplace and take advantage of all the platform's features is €49.99 excluding VAT (rate in force in 2023). It is the same for all sellers, and the amount is fixed.

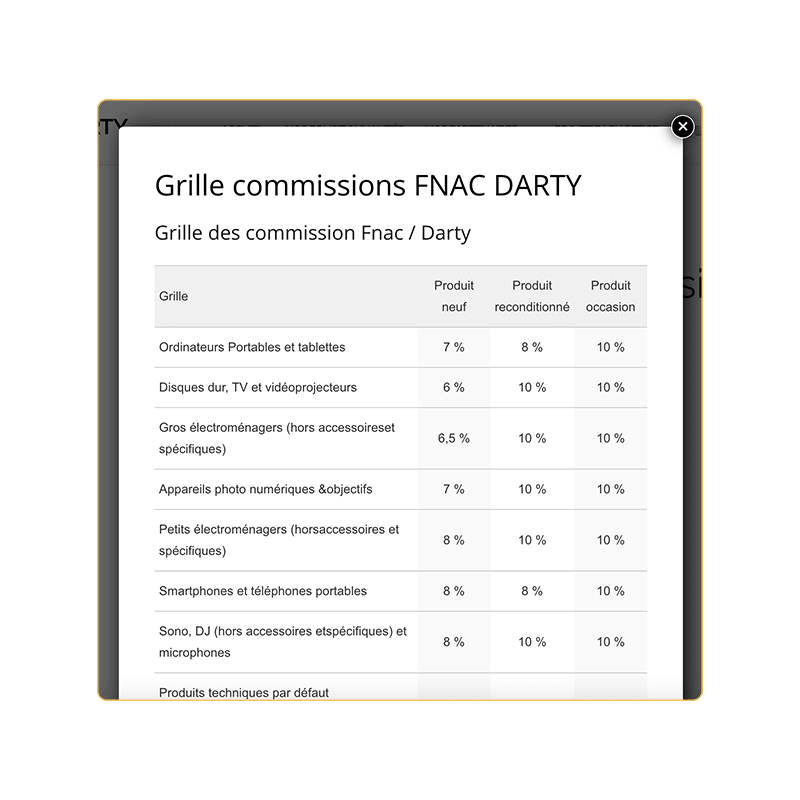

Darty commission rate

During a transaction between a buyer and a professional seller on marketplace Darty charges a commission on the price of the item, excluding VAT. The rate applied varies according to the product category and its condition (new, used or reconditioned). It generally varies between 7% and 15%.

Examples of Darty commission rates

| New products | Refurbished product | Used product | |

| Laptops and tablets | 7% | 8% | 10% |

| Hard drives, TVs and projectors | 6% | 10% | 10% |

| Large appliances | 6,5% | 10% | 10% |

| Digital cameras & lenses | 7% | 10% | 10% |

| Smartphones and cell phones | 8% | 8% | 10% |

| Books | 13% | 15% | 14% |

| DIY | 12% | 15% | 15% |

| Bedding, Household linen | 15% | NA | NA |

| Furniture | 15% | NA | NA |

Darty commission & sales revenue

Once you've understood how Darty's sales fees work, it's important to know how they are taken into account from an accounting point of view. When a sale is made, the marketplace collects the money and pays it back to you a few weeks later, deducting its commission.

Staggered receipt of sales money

Darty's payment terms average 11 days, and can be as long as 30 days in some cases. This means that although you may have invoiced your customer, you won't receive the money from the sale in your business bank account for several weeks. What's more, the money you receive corresponds to the amount of the sale from which the famous commission has been deducted. This cash flow gap caused by Darty's sales charges needs to be taken into account in your accounting management, as it can have an impact on your supplier orders.

Ship today and get paid tomorrow with the D+1 payment solution on Darty Marketplace from Qashflo

Test your eligibilityHow do I declare my sales with Darty commissions?

Let's take the example of the sale of a used laptop, which you sell to your customer for €1,000 excluding VAT. For this type of second-hand product, the Darty commission is 10%, i.e. €100 excluding VAT. Once your order has been dispatched, you'll need to wait between 11 and 30 days for marketplace to pay you €1,000 excluding VAT - €100 excluding VAT = €900 excluding VAT. From an accounting point of view, you will declare the invoiced sales, i.e. 1000€ HT. The €100 (excl. VAT) commission will be categorized in a specific expense account.

Other fees at Darty

In addition to sales costs and the Darty commission, other expenses will need to be anticipated to keep your online sales business running. These must be taken into account when drawing up your business plan.

Shipping and delivery costs

All e-commerce sellers need to use carriers to get their parcels to their customers. There are several options on the market:

- Opt for a home delivery service (La Poste, DHL, Colis Privé, Chronopost...).

- Opt for relay point delivery (Mondial Relay, Relais Colis, Shop to Shop by Chronopost...).

Your customers pay you shipping costs, and you pay for the services you provide. Some service providers charge per shipment, while others offer subscription-based packages. Make sure you know the rates of the various service providers, and don't hesitate to negotiate preferential prices if you sell a certain volume.

Darty advertising costs

Setting up sponsored product campaigns and distributing marketing banners on marketplace Darty incurs advertising costs. These are invoiced on a CPC (cost-per-click) basis. In other words, as soon as someone clicks on your banner or sponsored product, you're billed. The more clicks, the lower the cost per click. With this type of campaign, you can generally allocate the total budget of your choice, choose your targeting and specify a maximum CPC that must not be exceeded to remain profitable.

Other advertising expenses

From a marketing point of view, the use of other advertising tools should also be taken into account in your costing. Campaigns on social networks or Google can also be set up for CPC billing. You therefore need to set aside a monthly budget to spend on these platforms to gain visibility and conversion.

Inventory procurement costs

Among the big Darty selling costs to anticipate, you mustn't neglect the cost of buying stock. Buying your initial stock is a good thing, but you need to think about future replenishment. Cash flow is therefore essential not only to buy back items and avoid stock-outs, but also to develop new product ranges and grow your business.

How can I maintain a steady cash flow despite the Darty payment delay?

As you may have guessed, marketplace Darty only pays you the money from your sales a minimum of 11 days after your shipments. This means you don't receive your money within this timeframe, which can create a cash flow shortfall. Without cash flow, you can't buy back stock, risk stock-outs and jeopardize your business.

To alleviate this problem, Qashflo offers a cash advance solution, enabling you to receive cash the day after your shipments. On the budget side, expect to pay a monthly Qashflo subscription (from €100 ex. VAT to €300 ex. VAT/month depending on your status and the number of marketplaces you use) and a commission on the funds advanced (from 1%).

Test your eligibility

Our teams will contact you as soon as possible to discuss the possibility of financing your D+1 sales.