Contents

For many e-commerce sellers, selling on marketplaces represents a major business opportunity, as they attract millions of buyers every day. Before considering selling on Amazon, it's imperative that you find out about the various Amazon selling fees you'll be liable for as a professional seller. Follow our guide!

Amazon sales fees: how they work

Like all marketplaces, Amazon offers its sellers the benefit of its online sales platform, in return for a sales fee. For the American giant, fees are divided into two categories: the monthly subscription fee and the commission rate per sale.

Amazon Seller monthly subscription

Among Amazon's sales fees, the monthly subscription corresponds to a predefined flat rate, billed to the professional seller by the marketplace. It is paid monthly and gives the merchant access to a wide range of features: Amazon store creation, advertising service, logistics service, etc.

Amazon commission rates

To feed your product strategy, turn to tools that analyze current trends and consumer searches. There are many such tools, some free, some not. Among the best known: Google Trend, Answer the public...

Selling on Amazon: prices

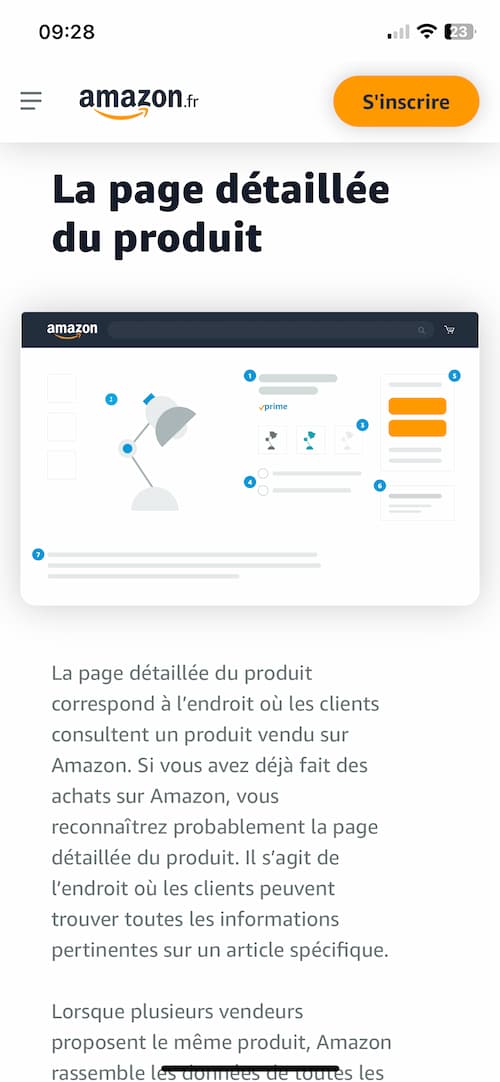

When you register to become an Amazon seller, the platform lets you choose between two types of profile: Individual Seller and Professional Seller. This choice has an impact on operating costs, and therefore implies different Amazon selling fees.

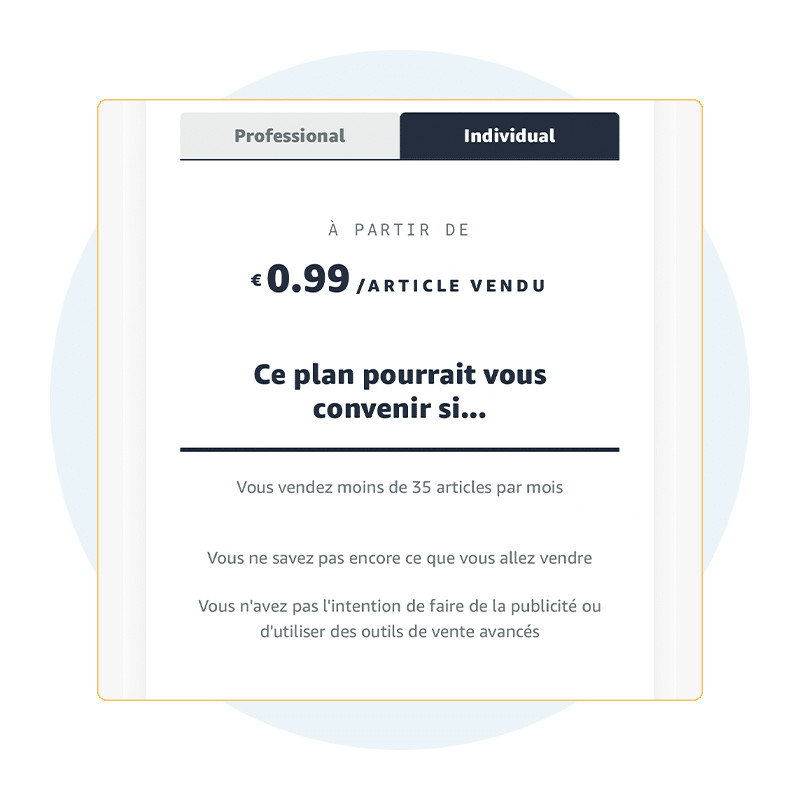

Individual plan

Who's it for?

For independent salespeople making fewer than 40 sales a month.

How much does it cost?

A commission of €0.99 (excl. VAT) per item sold.

Additional Amazon sales fees of between 8% and 15%.

Advanced sales tools are not available for this type of salesperson.

Business plan

Who's it for?

For companies and professional sellers with more than 40 monthly sales.

How much does it cost?

A subscription fee of €39 excl. tax per month.

A commission of between 8% and 15% depending on product category.

All sales tools are available, as well as restricted product categories.

What are Amazon sales fees for?

Amazon sales fees are intended to cover the costs associated with running the platform and developing marketplace worldwide (sales infrastructure, ancillary services, employees, warehouses, etc.).

Amazon commission & seller sales

When you sell on marketplace, you don't collect money directly from your buyers. The marketplace collects the money generated by your sales, and pays you the amount of your conversions in advance.

Amazon payments

On Amazon Marketplace, you receive the money from your sales between 14 and 28 days after your products have been shipped. The amount paid corresponds to the sales amount minus the Amazon sales fee.

Ship today and get paid tomorrow with Qashflo's D+1 payment solution on Amazon Marketplace

Test your eligibilityHow to declare your sales?

As you can see, when you invoice a customer for a €100 basket (excluding VAT), you will receive a lower amount from marketplace , because Amazon's sales costs will have been deducted beforehand. So how do you declare your sales? From an accounting point of view, if you're a company, you'll need to declare the sale of €100 (excl. VAT). You can then tell your accountant the amount of the Amazon commission, which he or she will categorize in a specific expense account.

Special case of micro-entrepreneurs

If you sell on Amazon as a micro-business (sole proprietorship), you only need to declare to Urssaf the amount received in your business bank account. Your charges will therefore be calculated on the basis of the sales actually received. On the other hand, this status is far from being the most favorable for an e-commerce business, as it doesn't allow you to recover the charges linked to your activity when you balance your books: inventory, Amazon selling costs, operating costs, supplies...

Other charges on Amazon

In addition to the specific fees related to commissions on transactions, you'll be charged other types of Amazon sales fees.

Shipping costs

As an Amazon seller, you have several options for shipping your products:

- Manage your own parcel delivery via various carriers (La Poste, Mondial Relay, GLS, UPS...),

- Subscribe to marketplace 's dedicated "Shipped by Amazon" service, which takes care of storage and shipping for you.

Costs depend on the type and number of carriers. Shipped by Amazon is included as standard in the Professional Seller plan. You will be charged an additional storage fee, depending on your usage.

Administrative costs of reimbursement

On Amazon, your customers can request a refund of their order in the event of a problem (lost package, defective product, etc.). In this case, if you have already received payment for the sale, marketplace will reimburse your Amazon sales charges. On the other hand, administrative costs related to the refund may be applied. This is either €5 or 20% of the sales charge relating to the transaction.

Advertising costs

On Amazon Marketplace, you can boost your sales by setting up advertising campaigns. The marketplace offers this service to highlight your product listings to Internet users searching for similar products. The service is billed on a cost-per-click (CPC) basis. The amount of the CPC depends on a number of factors: product type, number of clicks, competition, time of year...

Supply costs

Even if they are not directly linked to the use of marketplace , the cost of selling your stock should not be overlooked. Your challenge is to always be supplied so as not to risk stock-outs. Without products, there are no sales, and without sales, your entire online business can be jeopardized.

Amazon payments and inventory management

The most common problem with Amazon is that the platform only pays you the money from your sales within 14 to 28 days, depending on the situation. You sell your products, but don't immediately have the cash you need to replenish your inventory. This time lag can have a serious impact, as it can lead to stock-outs. To avoid this phenomenon, third-party services such as Qashflo provide you with a cash advance the day after your shipments. Thanks to this kind of solution connected to your marketplace, you benefit from a regular cash flow, enabling you to replenish your supplies, expand your product ranges and pursue your development without constraints.

6 questions about Amazon's sales fees and how it works marketplace

- Can I switch from an Individual Seller to a Professional Seller?

Yes. If you opt for an individual plan on Amazon marketplace, you can switch to a professional seller account as soon as you exceed 40 sales per month. - What is Amazon FBA?

Amazon FBA is Amazon's "fullfilment" service, also known as "Shipped by Amazon". It allows you to delegate storage and shipment management to the platform. Your products are stored in Amazon warehouses throughout France and/or Europe. As soon as an order is placed, the logistics department packs and dispatches the package to your customers. - How do I pay the Amazon sales fee Marketplace ?

The monthly subscription fee is deducted from your business bank account each month. The commission is deducted directly by marketplace when you receive your sales. - How can I offer my products for Amazon Prime delivery?

You need to subscribe to the "Prime Shipped by Seller" option. This program enables you to deliver directly from your warehouses to Prime customers in France and abroad. A "Prime Delivery" badge is then displayed on your seller profile and product sheets. To be eligible, your company must meet a number of criteria: meet delivery deadlines (on-time delivery rate of at least 90%), have a cancellation rate of less than 0.5%, etc. A preliminary trial period is set up by marketplace to ensure your eligibility for the service. - Which products have the lowest sales commission on Amazon?

Amazon commission rates mostly vary between 8% and 15%. The categories with the lowest rates (in the 8% range) are computer products, standard-sized household appliances, video game consoles and baby and childcare products. - What are the highest Amazon commission rates?

The products with the highest sales costs, particularly in terms of commission (around 15%), are books, shoes, kitchen and home products, accessories and luggage, mattresses, music, video and DVD products, software, pet supplies and sports and leisure products...

Test your eligibility

Our teams will contact you as soon as possible to discuss the possibility of financing your D+1 sales.